-

What to Do If Your Medical Bill Is Sent to Collections–How to Negotiate a Lower Payment with a Debt Collector

Medical debt is a heavy burden, but it’s especially stressful when debt collectors start calling and demanding payment. But don’t panic. You may be able to deal with debt collections so it won’t affect your credit report or lead to financial ruin. With a little bit of knowledge and a lot of persistence, you can…

-

Can I Be Sued Over Medical Bills?

It’s a question asked by far too many Americans. Medical debt is the number one cause of bankruptcy in the United States. About 40% percent of U.S. adults, or about 100 million people, are in debt because of medical or dental bills. When you’re looking at mounting hospital bills, listening to calls from collection agencies,…

-

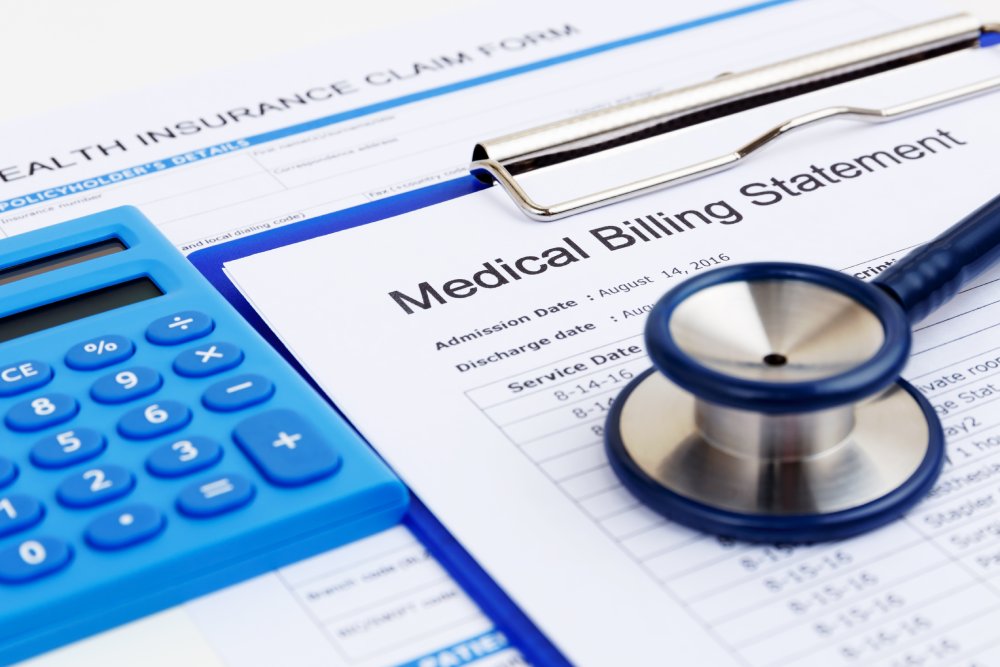

Do Medical Bills Affect A Credit Score?

It seems that no matter what medical problem you have, there’s going to be a large bill attached to it. Even if you’ve got good insurance and pay your co-pay, there will also be little things (or big things) that get added on, whether they’re labs, x-rays, other radiology, physical therapy, nutrition consulting, and on…

-

How Can I Get Help Paying Medical Bills?

Have you been hit with unaffordable medical bills after a trip to the hospital or ER? Perhaps you found out the hard way that your insurance didn’t offer you enough coverage for these unanticipated expenses. Or worse, you had no healthcare coverage when you had to seek medical services. If this makes you worry about…

-

How To Protect Yourself From a Lifetime of Medical Debt

Medical debt is a reality for over 100 million people and the primary cause of bankruptcy in the U.S., even though the majority have health insurance. However, even with great medical insurance, a stressful health crisis can spiral into a financial disaster and a lifetime of medical debt. But what if we told you that…

-

How Much is an ER Visit Without Insurance?

As anyone who has ever been to the emergency room can tell you, an ER visit is expensive. And it’s expensive under the best of circumstances where you have good health coverage. But when you go to the emergency room without insurance the price can very quickly get into the thousands. Why Do So Many…

-

Before You Put That Medical Bill on a Credit Card, Read This!

When faced with medical debt, it can be tempting to resort to credit cards as a solution. However, relying on credit cards to pay off medical expenses can have long-lasting negative consequences for your financial future. In this blog post, we will look into three important reasons why using credit cards for medical bills should…

-

How to Remove Medical Debt from Credit Reports

If a medical debt collections agency has contacted you, you’re not alone. One in five households in the United States has overdue medical debt, and the sad fact is that many of those debts are false or in error. A debt collector may have contacted you. They may tell you to pay or your information…

-

How To Reduce Hospital and Medical Bills

After applying the three-step process to lower any medical bill, read about additional ways to get your hospital or medical bills reduced.