Medical debt is a heavy burden, but it’s especially stressful when debt collectors start calling and demanding payment. But don’t panic. You may be able to deal with debt collections so it won’t affect your credit report or lead to financial ruin. With a little bit of knowledge and a lot of persistence, you can significantly reduce your medical debt and negotiate a lower settlement.

How to Negotiate a Collection Account

Unfortunately, our medical bills can be sent to collections even if we’re making payments. However, as of 2022, medical debt can only be reported to credit agencies after 12 months of non-payment. This gives you some time to dispute the bill and negotiate a lower settlement before it affects your FICO score. But, don’t procrastinate! A long, exhausting battle of phone calls, emails, and letters may lie ahead.

Keep Good Records

It’s important to keep good records of all phone calls and correspondence. When making these phone calls, get the name, time, date, and phone call reference number of the person you speak to. Also, make sure to get any agreements in writing.

This will help you negotiate and prevent the debt from ruining your financial life. Additionally, if you eventually must file a formal complaint with your state’s insurance commission, fight a lawsuit, or contact an attorney you’ll have accurate records.

Start Here – Verify that You Owe the Debt

If contacted by a collection agency ask them to validate the debt with the original creditor–the provider. If they can’t validate the debt, they can’t enforce the collection of the debt. According to the Fair Debt Collections Practices Act, debt collectors must stop all collection activities, calls, and letters unless and until the alleged debt is verified in writing.

When you get a first call from a debt collector, request:

- an itemized bill with CPT codes, “per your rights under HIPAA”, and

- a payment agreement with your signature, “per your rights under the Fair Debt Collections Practices Act”.

When you get a written notice of an alleged debt, respond with a letter requesting:

- an itemized bill with CPT codes, “per your rights under HIPAA”, and

- a payment agreement with your signature, “per your rights under the Fair Debt Collections Practices Act” within 30 days of getting the written notice. A template of a letter requesting verification of a debt is linked here.

Make sure you know what debt the collection agency is trying to collect for, and compare it to the bills you’re aware of. Also, if insured, compare your bills to any Explanation of Benefits to see if something was not covered that should have been. If you don’t recognize the debt, call the agency. The agency must either supply you with the bills or refer you to the hospital or clinic where the debt was accrued.

If you do have a signed financial agreement, consult with an attorney. Sometimes signed agreements, such as agreements signed under duress, may be determined invalid.

Request to Pause Collections when Disputing Medical Debt

Write a letter requesting the bill collectors to pause collection activities when:

- applying for financial assistance

- disputing your bill

- appealing an insurance claim denial (the hospital will usually agree for 30 to 90 days)

Apply for Financial Assistance

If you haven’t already, apply for financial assistance as soon as possible. Most hospitals have a 240-day (about 8 months) deadline to apply, even if the bill is in collections. If using a nonprofit facility, Section 501(r)(6) of the IRS requires a hospital organization to make reasonable efforts to determine whether an individual is eligible for assistance under its policy before engaging in extraordinary collection actions.

Check the facility’s website or ask them for a copy of their Financial Assistance Policy (FAP) and application. You can also quickly screen and apply for hospital charity care, or income-based discounted care, at DollarFor.org.

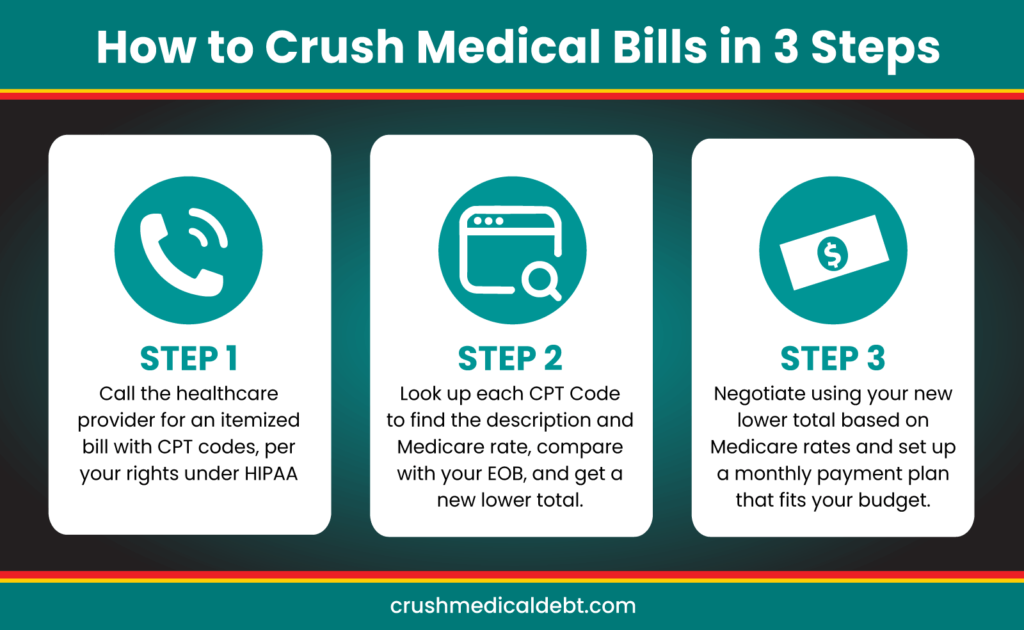

Lower Your Medical Bills Using the 3 Steps

The first bill you get from a medical provider is often bogus. It will frequently contain mistakes and overcharges that need to be corrected. Therefore, you need to dispute your bill using the 3 steps of the only right way to pay a medical bill.

- Ask for the itemized bill with CPT codes, per your rights under HIPAA.

- Look up the CPT codes to verify that the descriptions match the services received. If insured, compare the bills with your Explanation of Benefits. Then, find the amount Medicare will pay using an internet search or AI chatbot (such as ChatGPT).

- Call the provider to arrange a payment plan with your new total based on what Medicare would pay. You may be able to settle your debt, pay off your debt with partial payments, get on a better repayment plan, or offer to pay a lump sum that’s lower than the full amount.

You can learn these steps in more detail in our article, The Best Way To Pay Medical Bills In 3 Steps.

By following Crush Medical Debt, you will learn to get ahead of medical debt through medical financial literacy. You will also find articles explaining other ways to lower your out-of-pocket spending, understand healthcare coverage, and fight medical debt.

Article Highlights

- If you receive a bill from a debt collector, start by verifying the debt is valid. Ask for the original provider’s itemized bill and a copy of the document with your signature agreeing to pay the bill.

- Request bill collectors pause collections when appealing an insurance denial, disputing your bill, or applying for financial assistance.

- Apply for hospital financial assistance, including charity care.

- Nonprofit hospital facilities must first allow you to apply for financial aid before taking aggressive or extraordinary collection actions.

- Lower your bills and negotiate fair payments using the 3 Steps to Paying a Medical Bill

- Follow Crush Medical Debt to increase your medical financial literacy.

- Check out the Resources below for more helpful information.

Helpful Resources

- Go to Dollarfor.org to quickly screen and apply for hospital charity care for free.

- Patientadvocate.org helps with case management services and financial aid for people with chronic, life-threatening, and debilitating illnesses for free.

- Sign up for our free Medical MoneyLetter to learn more.

Related Articles about Medical Debt Reduction and Your Credit Score

- Can I Be Sued Over Medical Bills?

- Do Medical Bills Affect a Credit Score?

- How to Remove Medical Debt from Credit Reports

- Before You Put That Medical Bill on a Credit Card, Read This!

- Know Your Rights and Protections When it Comes to Medical Bills and Collections

- How To Protect Yourself From A Lifetime Of Medical Debt

- How to Reduce Hospital and Medical Bills

- The Best Way to Pay Medical Bills in 3 Steps

- Dollar For Negotiation Manual