We understand that retiring with medical debt can be overwhelming, but you’re not alone. Our goal is to provide you with free resources and information to help you navigate the challenges of medical debt during your retirement years. In this guide, we’ll explore various strategies and tools to manage medical debt, maximize your health insurance coverage, and make informed financial decisions.

Understanding Medical Debt in Retirement

Retiring with medical debt can put a strain on your finances and peace of mind. Medical debt refers to the expenses you incur for medical care that remain unpaid. It’s essential to address these obligations promptly to avoid negative consequences, such as damage to your credit report. Fortunately, there are several resources available to help you tackle medical debt and maintain financial stability throughout retirement.

1. Patient Advocate Foundation (PAF):

PAF offers free assistance and guidance to retirees struggling with medical debt. They can help you navigate insurance-related issues, negotiate with healthcare providers, and explore financial aid options. Visit www.patientadvocate.org for more information.

2. National Consumer Law Center (NCLC):

NCLC provides resources and publications that help you understand your rights and options regarding medical debt. They offer valuable information on consumer law issues and can assist you in managing your debt. Explore their website at www.nclc.org.

3.State Health Insurance Assistance Programs (SHIPs):

SHIPs offer free counseling and support on health insurance matters, including medical debt. They can help you understand your insurance coverage, assist with billing issues, and provide information about financial assistance programs. Find your state’s SHIP contact information at www.shiptacenter.org.

4.Federal Trade Commission (FTC):

The FTC provides educational materials and resources on dealing with medical debt. Their website, www.ftc.gov, offers information on your rights under the Fair Debt Collection Practices Act (FDCPA) and provides sample letters to communicate with debt collectors.

5.Local non-profit credit counseling agencies:

Many local non-profit organizations offer free credit counseling services. They can help you create a budget, negotiate with creditors, and develop a plan to manage your medical debt. Use the National Foundation for Credit Counseling’s locator tool at www.nfcc.org to find a counseling agency near you.

6. Benefits.gov:

This comprehensive database helps you search for federal and state benefit programs that can assist with medical debt. Explore the website to find programs that offer financial aid or medical bill assistance based on your specific needs and eligibility.

7. Medicare:

If you’re 65 or older, Medicare is a valuable resource for managing medical debt. Familiarize yourself with the various coverage options, including Medicare Advantage plans, to find the best fit for your healthcare needs. Visit the official Medicare website at www.medicare.gov for detailed information.

8. Social Security Administration:

The Social Security Administration offers information and assistance related to retirement benefits. Understanding your Social Security benefits can help you offset medical care costs and manage your overall financial situation effectively. Visit www.ssa.gov for more information.

9. Local hospitals and healthcare providers:

Reach out to your local hospitals and healthcare providers to inquire about financial assistance programs they may offer. These programs can provide discounts, payment plans, or even charity care for retirees facing medical debt.

10. 211 Helpline:

Dialing 211 connects you to a helpline that can provide information and referrals to various social services, including resources for managing medical debt. They can help you find local programs and organizations that offer financial assistance. Dial 211 or visit www.211.org to access this service.

Remember to research each resource to understand the specific services they provide and how they can assist you in managing your medical debt effectively.

Maximize Health Insurance Coverage

Health insurance is a crucial aspect of managing medical debt in retirement. Ensure you have a comprehensive understanding of your health insurance options, such as Medicare coverage. Medicare is a federal program available for individuals aged 65 and above, providing essential health coverage. It’s important to explore different Medicare plans, including Medicare Advantage (Part C) plans, to find the best fit for your needs.

Leverage Social Security Benefits

In retirement, your Social Security benefits can serve as a valuable resource to manage medical debt. These benefits can help offset medical care costs and provide financial stability. By strategically planning your finances, you can optimize your Social Security benefits to alleviate the burden of medical debt.

Effective Debt Management Strategies

Managing medical debt requires a proactive approach.

- Consider developing a budget that focuses on paying down your medical bills systematically.

- Prioritize your debts

- Explore negotiation options with healthcare providers

- Seek assistance from nonprofit credit counseling agencies.

Maintain Financial Wellness

While addressing medical debt, it’s essential to maintain overall financial wellness during retirement.

- Keep a close eye on your credit report to ensure accuracy and identify any potential issues.

- Stay vigilant with your credit cards

- Make timely payments

- Manage your credit utilization wisely.

Takeaways

Retiring with medical debt can be challenging, but it’s crucial to remember that there are free resources and strategies available to help you manage and overcome this financial burden. By maximizing your health insurance coverage, leveraging social security benefits, exploring financial assistance programs, utilizing health savings accounts, and implementing effective debt management strategies, you can navigate medical debt in retirement with confidence. Crush Medical Debt is here to support you every step of the way. Remember, you’re not alone in this journey.

And now the following article is being used with permission from Retire Guide.

Key Takeaways

- Negotiate lowering your medical bill before coming up with a payment plan.

- Make sure your payment plan for your debt is realistic, with a goal to eliminate your debt within three years or less.

- Consider government programs, like Medicare, Medicaid or Extra Help to cover medical costs.

- There are free nonprofit organizations to help you manage your medical debt, like the United Way and Dollar For.

Understanding Medical Debt

A steady trend presents retirees with a dilemma: Health care costs are steadily rising with inflation and income levels aren’t keeping up. Nearly one in 10 adults owe medical debt, with some owing over $10,000, according to the Kaiser Family Foundation.

“Medical debt is one of the highest increasing expenses in people’s everyday budgets that’s just continuing to get bigger and bigger,” Julianna Miller, AFC®, the Founder of Life Money Management told RetireGuide.

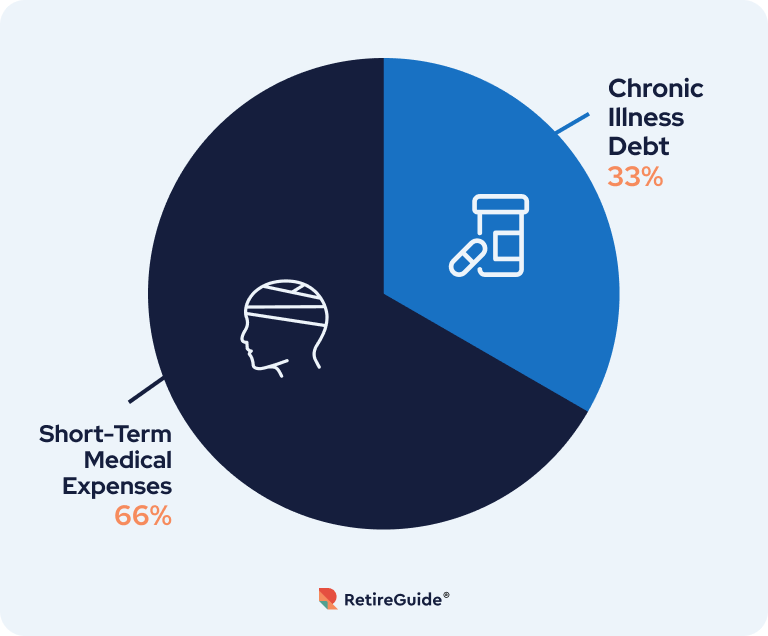

The New York Times conducted a medical bills survey with the Kaiser Family Foundation. The survey results showed that 66% had medical debt for a short-term medical expense, such as a hospital stay or treatment, and 33% had medical debt that built up over time from a chronic illness, like cancer.

When your finances are already tight, a hefty medical bill can make a comfortable retirement feel impossible. Those with a lower income or disabilities are even more susceptible to high medical debt, according to KFF.

If you don’t learn how to manage medical debt, whether for yourself or a loved one if you’re their caretaker, it’ll be difficult to save for retirement. In severe cases, you may have to declare bankruptcy or risk losing your home.

What Are the Biggest Risks People Face in Retirement?

Managing Medical Debt During Retirement

If you’re already retired, you can face difficulties managing your medical debt on a potentially fixed income. According to a brief from the Center for Retirement Research, the typical retiree only has 75% of Social Security benefits and 88% of regular income remaining after paying back medical costs.

This doesn’t leave much wiggle room to add to your savings or investment vehicles. In most cases, especially if you’ve been hit with a sudden, costly illness, it will take time to pay off your medical debt.

It’s important to come up with a well-thought-out plan to pay off your debt. “A good rule of thumb is if you can’t work out a payment plan that will let you pay off that debt in three years or less, you probably need to get help to negotiate some sort of settlement with that debt,” Gerri Detweiler, a debt expert, told RetireGuide.

“A trap that people will fall into is agreeing to a payment plan on medical debt that just won’t get them anywhere. They’ll agree to pay $10 or $20 a month on a debt that’s thousands of dollars and they don’t have any idea whether interest is being charged or how long it will take them to pay it back.”

There are other ways to manage your medical debt, like maximizing your Social Security benefit and avoiding Medicare late enrollment penalties.

“A good rule of thumb is if you can’t work out a payment plan that will let you pay off that debt in three years or less, you probably need to get help to negotiate some sort of settlement with that debt.”

GERRI DETWEILER – DEBT EXPERT

5 Tips To Manage Your Medical Debt

Negotiate the bill and come up with a realistic payment plan. Confirm if the amount is correct and whether you will be charged interest. Try to come up with a plan to pay off your debt within a few years or less. Look into Medicaid for long-term care. Long-term care can cost up to $9,960 a month in 2023 if you need to stay in a nursing home, according to the Genworth Cost of Care Survey. While Medicare doesn’t cover long-term care — Medicaid does. Look into the eligibility rules to see if you qualify. Medigap to cover Medicare coverage gaps. Medicare Part B covers 80% of most outpatient care and services while the other 20% falls into your lap. If you must treat a costly new chronic disease, you could consider a Consider Medigap plan to cover the remaining 20% to reduce your medical debt. Maximize your Social Security benefit amount. If you haven’t already started collecting your Social Security benefits, your benefit amount will increase if you wait until you reach your full retirement age. You could also continue working if you earn a higher salary to replace lower earning years. This way, your higher benefit can help you pay off your medical debt in years to come. Avoid the Medicare late enrollment penalty. If you miss signing up for Medicare during your open enrollment period, you will face a late enrollment penalty. Some penalties, like the Part B penalty, lasts your entire life. You can keep more money in your pocket to manage debt by enrolling for Medicare coverage on time.

Planning Ahead for Medical Costs

On average, those over 65 can expect to pay $67,000 in out-of-pocket medical costs over the remainder of their lifetime, according to the Center for Retirement Research. It may be worth looking into your family’s health history to start planning for potential medical costs.

“People don’t reassess their health insurance coverage often enough, especially when they’ve been diagnosed with a new condition,” Gal Wettstein, the senior research economist at the Center for Retirement Research at Boston College, told RetireGuide.

“If you’re aiming at a specific diagnosis, make sure that the plan you have offers good terms for the providers and medications that you will need.”

Does your family have a history of a chronic disease that will likely require extensive, costly treatment? If so, confirm whether the condition is covered by Medicare. If not, consider other options and bulk up your savings.

“I advocate for savings to cover potential medical debt. Whether your savings cut your deductibles, cover your copays or even your premiums, at some point, you’re going to need to cover expenses that are sometimes even more than your mortgage,” Julianna Miller, AFC®, the Founder of Life Money Management told RetireGuide.

“That’s a lot of money to have to plan for. Even if you have to start out with only a couple of dollars, it’s really important that you start to plan ahead.”

How To Plan for Medical Costs

- Review your family’s health history.

- Reassess your health insurance coverage yearly (especially if you have a new condition).

- Bulk up your savings to cover deductibles, copays and premiums.

- Consider Medicaid for long-term care costs (spend down if you’re not eligible).

Consider potential long-term care costs as well, which are not covered by Medicare. Those over 65 years old have a 70% chance of needing long-term care services, according to the Administration for Community Living. Long-term care can be required for years and result in a hefty bill.

This may beg the question, should you prepare by getting long-term care insurance? The answer depends on your financial stability. Wettstein offered advice on the security of long-term care insurance for those with low income.

“I don’t think a long-term care insurance policy is necessarily right for everybody, especially individuals faced with medical debt and very limited income assets. For example, people who are already eligible for Medicaid probably don’t need to get their own long-term care insurance,” Wettstein told RetireGuide.

Instead of considering long-term care insurance, consider Medicaid instead. There are income limits, which vary by state, to be eligible for Medicaid. If you’re on the cusp of becoming eligible, you could spend down your assets to qualify. This likely wouldn’t be too difficult if you’re spending thousands on long-term care services.

Negotiating and Settling Medical Debt

It’s in your best interest to always review and question items on your medical bills. Start by trying to lower the initial bill and then come up with a payment plan. According to the CEO of Medical Billing Advocates of America, three out of four medical bills have errors, which are commonly overcharges.

“Research what the typical costs are for your particular type of test or procedure. To get an estimate, you can upload your medical bills and credit sources to Clear Health Costs to see the costs of different procedures,” Detweiler told RetireGuide.

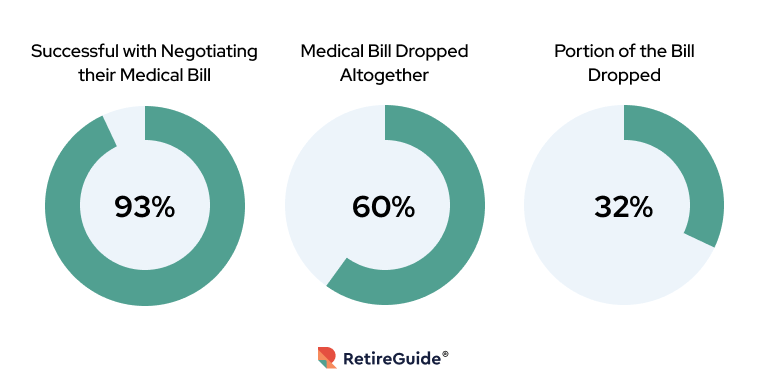

According to a U.S. survey with 1,550 participants, 93% were successful with negotiating their medical bill, 60% of the participants got the medical bill dropped altogether and 32% had a portion of the bill dropped. If you suspect you’re being overcharged for a medical service, negotiation has a successful track record.

Once you’ve negotiated your medical bill, request a payment plan. This can help avoid your debt from being sent to a collector. According to Detweiler, having a low income can be beneficial when negotiating your medical debt.

“If you’re on a fixed income, you’re actually in a much better position to negotiate debts. A lot of times, those with lower incomes are protected from creditors. You may be able to negotiate a better deal because your income protects you from creditors,” Detweiler told RetireGuide.

DID YOU KNOW?

Starting in 2023, national credit reporting companies announced that medical collections with a balance under $500 will no longer appear on consumer credit reports.

Source: Consumer Financial Protection Bureau

Resources for Managing Medical Debt

Medicare, Medicaid, Medigap, nonprofits and various government programs can help you manage your medical debt. Some resources have eligibility criteria in order to receive assistance.

Nonprofits are a free option that not everyone considers. They are typically a one-time resource and offer aid on a case-by-case basis.

“I often point people to the United Way, since they know which nonprofits are likely to cover medical expenses. They can check around with other nonprofits in the area, especially if they’re already helping with other low-income individuals,” Miller told RetireGuide.

“A lot of those places will help with covering other medical costs, like dental, eyeglasses and prescriptions.”

If you want someone to negotiate your medical debt on your behalf, consider Dollar For. Dollar For is a national nonprofit, funded by philanthropic grants and donations, so their services are free.

Each resource can cover different types of medical debt. For example, Extra Help is a government program that can cover drug costs. Learn how each resource can manage different medical costs to reduce your debt.

| Medical Debt Resource | Can help with costs for: |

|---|---|

| Medicare | Hospital visits, doctor’s visits, surgeries, drugs and more |

| Medicaid | Long-term care services, transportation services, hospital visits, doctor visits and drugs |

| Medigap | Remaining copayments, coinsurance and deductibles for Medicare |

| Nonprofits | Hospital visits, doctor’s visits, surgeries, drugs, dental and eyeglasses |

| Extra Help | Drug costs, including deductibles and copays |

| Medicare Savings Programs | Medicare premiums, deductibles, coinsurance and copayments |