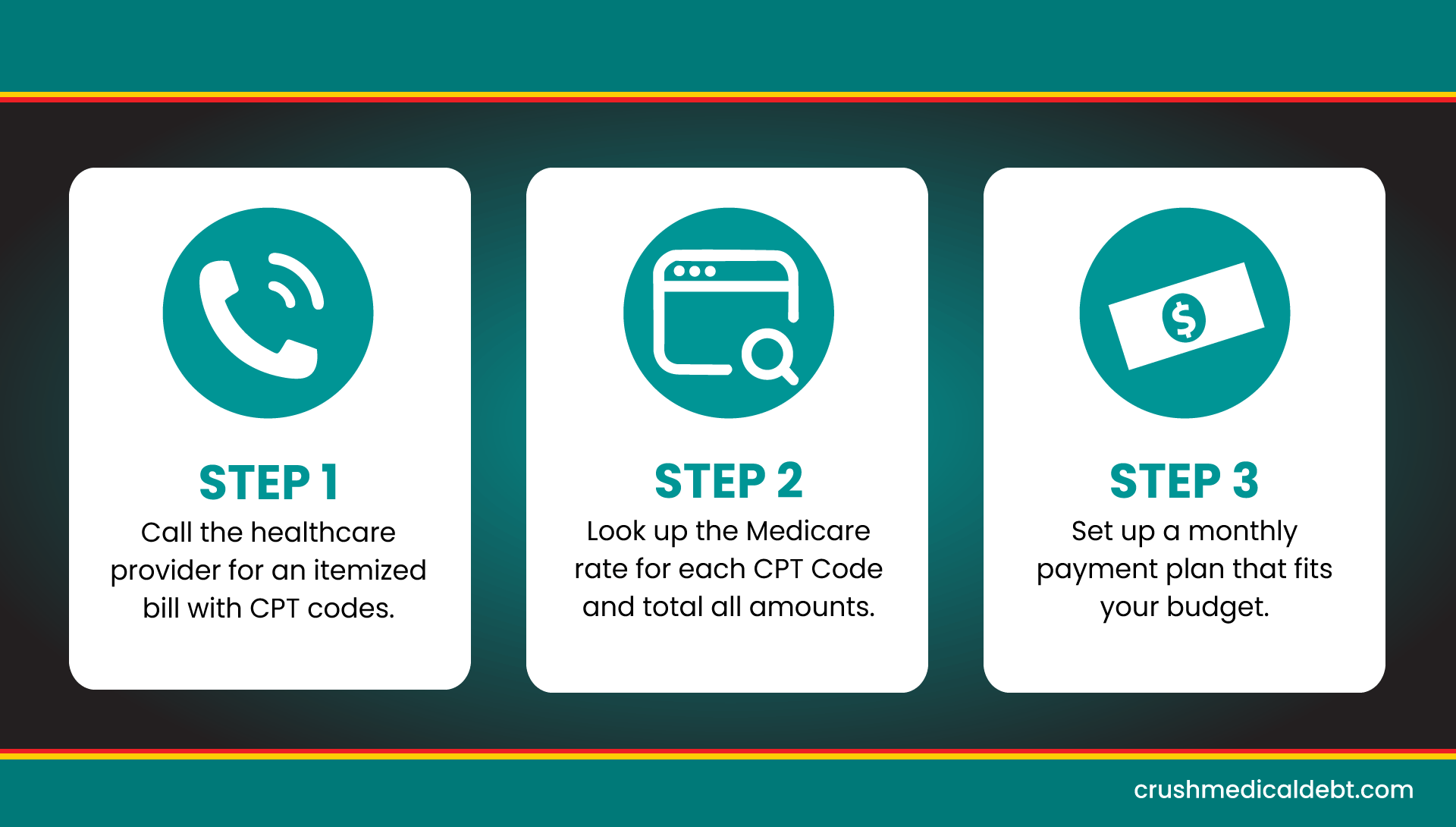

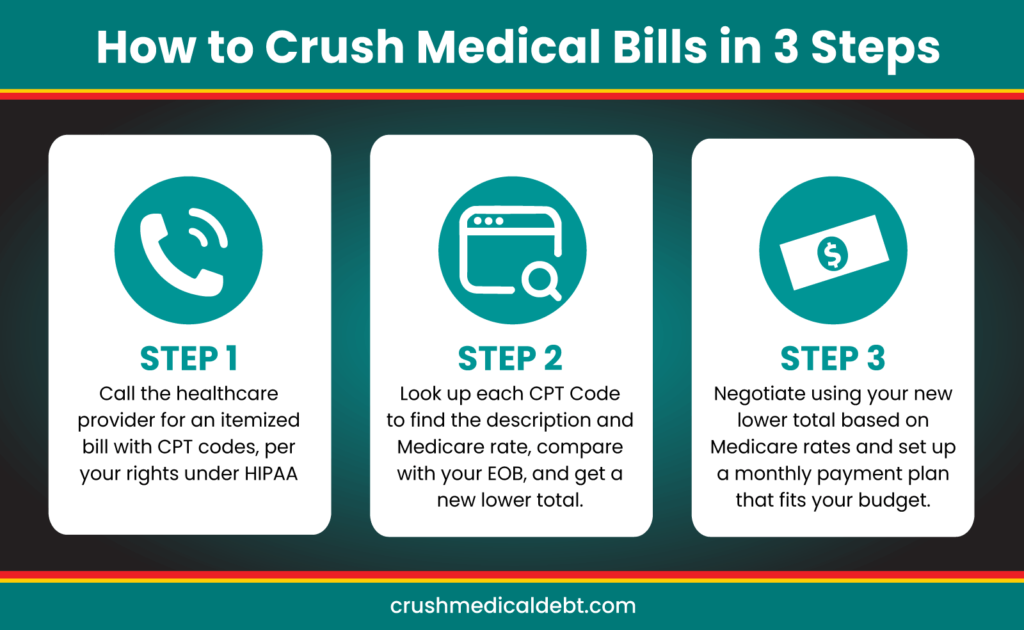

Dealing with medical debt can be extremely stressful, particularly if you’ve received unexpected or surprise medical bills. However, you don’t have to be a healthcare cost victim. The best way to pay off a medical bill and ensure that you’re not overpaying for medical services involves three steps. By following these steps, you can gain a better understanding of your medical bills, negotiate with your healthcare provider, and arrange a payment plan that works for your budget.

Step 1: Call the Provider to Ask for an Itemized Bill with the CPT Codes

When you receive a medical bill, it may not be clear which services were provided or how much you owe. This is where itemized bills with CPT codes come in. These standardized codes are used by healthcare providers to describe medical procedures and services. CPT codes allow insurance companies to determine what services were provided and how much they should pay the healthcare provider.

For each medical bill you receive, call the healthcare provider and ask for an itemized bill with the CPT codes. An itemized bill with CPT codes will help you:

- Gain a better understanding of the services you received and the costs associated with those services

- Determine if the bill is accurate

- Determine if you have been overcharged

- Negotiate with the provider

Don’t be discouraged if the billing department pushes back on you–they’re trained to do this. You need to be persistent and get the right information from them. It is your right under HIPPA laws and it could save you thousands!

You can read more details about itemized medical bills and CPT codes in our article, What is an Itemized Bill? If the provider won’t give you an itemized bill, read How to File a HIPAA Complaint When Your Medical Billing Office Won’t Give You an Itemized Bill.

Step 2: Search the CPT Codes to Find What Medicare Pays

Understanding your medical bill is your first step in taking control of your medical debt. Once you have the CPT codes, look up each code’s description using an internet search or AI Chatbot.

Medicare pricing provides a baseline for a fair price and can vary depending on the location and the healthcare provider. However, Medicare pricing is generally lower than what a regular patient would pay for the same services and can be as low as 10% of what is initially charged to a patient.

It is also crucial to know your health insurance policies and compare the Explanation of Benefits (EOB) to the itemized bills. By comparing your EOB and the CPT descriptions to your medical bill, you can:

- Ensure that the CPT descriptions match the healthcare services you received

- Discover billing errors and overcharges

- Discover where your insurance should have covered something and didn’t

Now that you know what Medicare pays for the CPT codes on your bill and you have removed any errors, add all Medicare amounts for all CPT codes to get a new, lower total. In our next article, How To Reduce Hospital And Medical Bills, you will learn some tips that may reduce the bill even further. Finding these things before you send money to the health provider is important.

Step 3: Call the Provider to Arrange a Payment Plan

The final step in paying off your medical bills is to call your healthcare provider and arrange a payment plan that works for your budget. When calling, be sure to have the CPT codes, Medicare pricing, and total in front of you so you can ask for a fair payment plan.

When negotiating with your healthcare provider, there are a few things to keep in mind:

- Tell the provider the amount that Medicare will pay and that’s what you will pay.

- Tell the provider what your budget is and how much you’ll be able to pay each month.

- Be honest about your financial situation and don’t agree to payment terms that you can’t afford.

- Make sure that the payment arrangement is interest-free.

- Get the negotiated payment arrangement in writing from the provider.

- Avoid using credit cards or personal loans to pay off medical bills, as they often come with high-interest rates that make the debt more difficult to manage. Also, payment plans made with medical providers don’t show up on your credit report. Medical bills paid with credit cards get included against your FICO credit score.

- Make the payments on time, as promised, or the bills can go to collections and hurt your credit score.

Takeaways

- Call the provider to ask for the itemized bill with CPT codes

- Research the CPT codes to find the amount Medicare will pay

- Call the provider to arrange a payment plan

By following these steps for every medical bill, you can avoid overpaying for medical services, negotiate a fair payment plan, and make payments that fit your budget. Need Some Help Crushing Your Medical Debt? See How Crush Medical Debt Can Help Today!