Few things are more boring than insurance documents and statements. However, to stay on top of your finances and not overpay for medical bills, you must pay special attention to your Explanation of Benefits (EOB). By following Crush Medical Debt™ you have learned to review and reduce your itemized medical bills, with or without insurance. However, if you have insurance you will also need to look at your EOB in Step 2 of the 3 Steps of the Only Right Way to Pay a Medical Bill.

Your EOB and itemized medical bill are complementary documents that explain what you are on the hook to pay out-of-pocket for your medical bills after insurance has paid its part. By reviewing and understanding these documents, you can ensure that insurance pays its share of your covered medical bills.

Health Insurance and Medical Debt

Since the passage of the ACA and the emergence of new free market non-insurance solutions such as Direct Primary Care (DPC), more people than ever are covered by some type of health coverage or insurance plan. You will often hear this celebrated in the media or by lawmakers as the solution to our nation’s medical debt crisis.

However, today most people with medical debt have health insurance! A low uninsured rate doesn’t mean everyone can now get the care they need. High deductibles, stagnant wage growth, and runaway out-of-pocket costs have left most Americans underinsured, or functionally uninsured. This is where understanding your boring insurance documents and comparing them to your itemized medical bills comes in handy.

Explanation of Benefits (EOB)

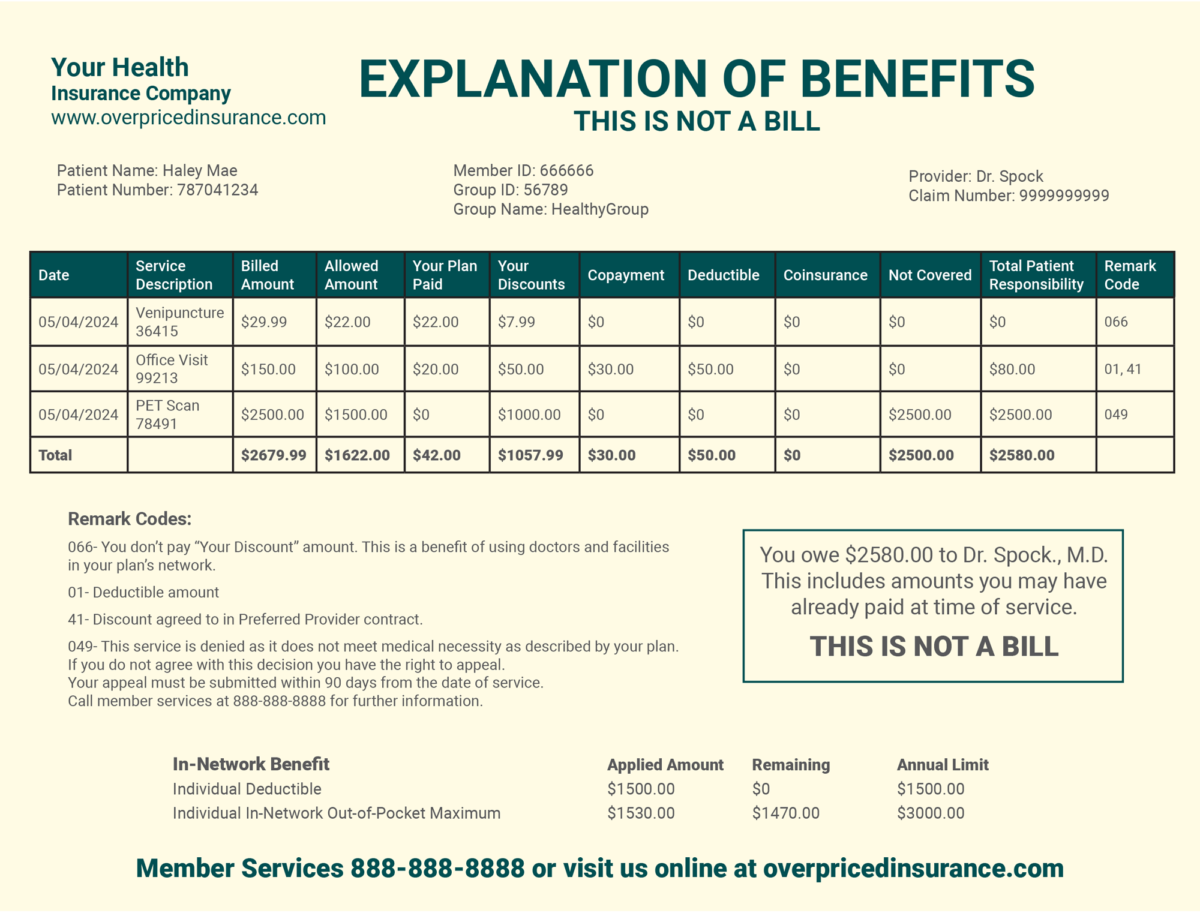

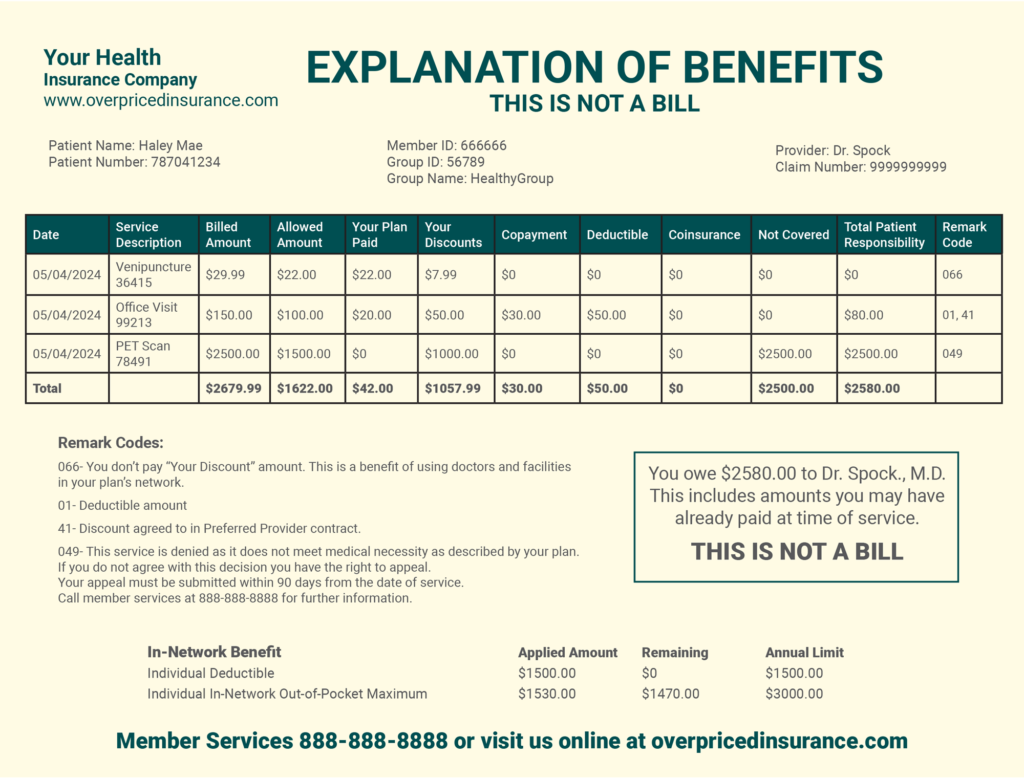

Each time your insurer pays for a service you use, they send you an Explanation of Benefits (EOB). The EOB serves as a summary of the claim. It can help you understand how much your health plan covers and what your provider will bill you.

An Explanation of Benefits tells you:

- what your insurance paid

- what the provider charged

- insurance allowed amount, or the maximum the insurance company is willing to pay

- what was applied to your co-pay, deductible or co-insurance

- your expected total out-of-pocket cost or balance left behind after the insurance pays its part

- your deductible and out-of-pocket maximum

- a “reason code” next to each charge will explain the coverage of each service.

- why something was not paid

- steps to take to appeal claim denials

Note: You will also get an EOB with a Medicare Advantage plan. However, with original Medicare, this document will be called a Medicare Summary Notice.

Explanation of Coverage (EOC)

Another important insurance document is your Explanation of Coverage (EOC). The EOC is sometimes called the Evidence of Coverage. Your EOC is the document that lists the services covered by your specific health plan.

When comparing health plans, the monthly premium may be your primary concern. However, it’s important to check that the services, doctors, facilities, and prescription drugs you know you will need are covered.

Your EOC also has exclusions, or items it won’t cover. Some health coverage plans may not cover reproductive services, fertility treatments, gender-affirming care, sports injuries, mental health or substance abuse treatments, etc. You want to know these details before you sign up for a particular insurance plan, which you can change yearly during Open Enrollment. By understanding your EOC, you will know which items or services should be covered by the insurance plan.

Comparing Your EOB and EOC With Your Medical Bills

By comparing your itemized medical bills with your EOB, you can often find errors resulting in overcharges or denials. For example, common errors such as a wrong code or a typo could result in your insurance not paying its share. These small problems can often be easily cleared with a phone call.

When comparing your itemized medical bills with your EOB and understanding your EOC, you will encounter claim denials for services that should have been covered. You’ll need to appeal these so you’re not stuck with the bill!

Follow our upcoming blog article series on insurance claim denials and what to do about them.

Takeaways

- Most people with medical debt have insurance or health coverage but remain underinsured.

- Your Explanation of Benefits (EOB) is a claim summary from health insurance that tells how much your health plan covers and what your provider will bill you.

- Your EOB also tracks your deductible and out-of-pocket maximum, tells you how to appeal claim denials, and more.

- You should review your itemized medical bill and EOB to ensure accuracy and understand your financial responsibility for medical bills.

- You should understand your Explanation of Coverage (EOC) to know which services should be covered by your health insurance.