one medical bill at a time.

-

How to Estimate Out-of-Pocket Healthcare Costs – Without or Without Insurance

Healthcare expenses are the biggest potential threat to your finances because, unlike other things we purchase, we frequently don’t know the full price upfront. Even having good insurance won’t guarantee that your out-of-pocket expenses won’t break the bank if you become seriously sick or injured. However, you can shop ahead for most non-emergency services and…

-

How Price Transparency Helps Reduce Out-of-Pocket Costs

Hospitals and medical providers haven’t always been transparent with their pricing. For decades, it was normal for us to have no idea how much we owed for medical care until the bill arrived. Surprise bills were common. As a result, millions, mostly insured patients, were left in debt. But in recent years, federal lawmakers heard…

-

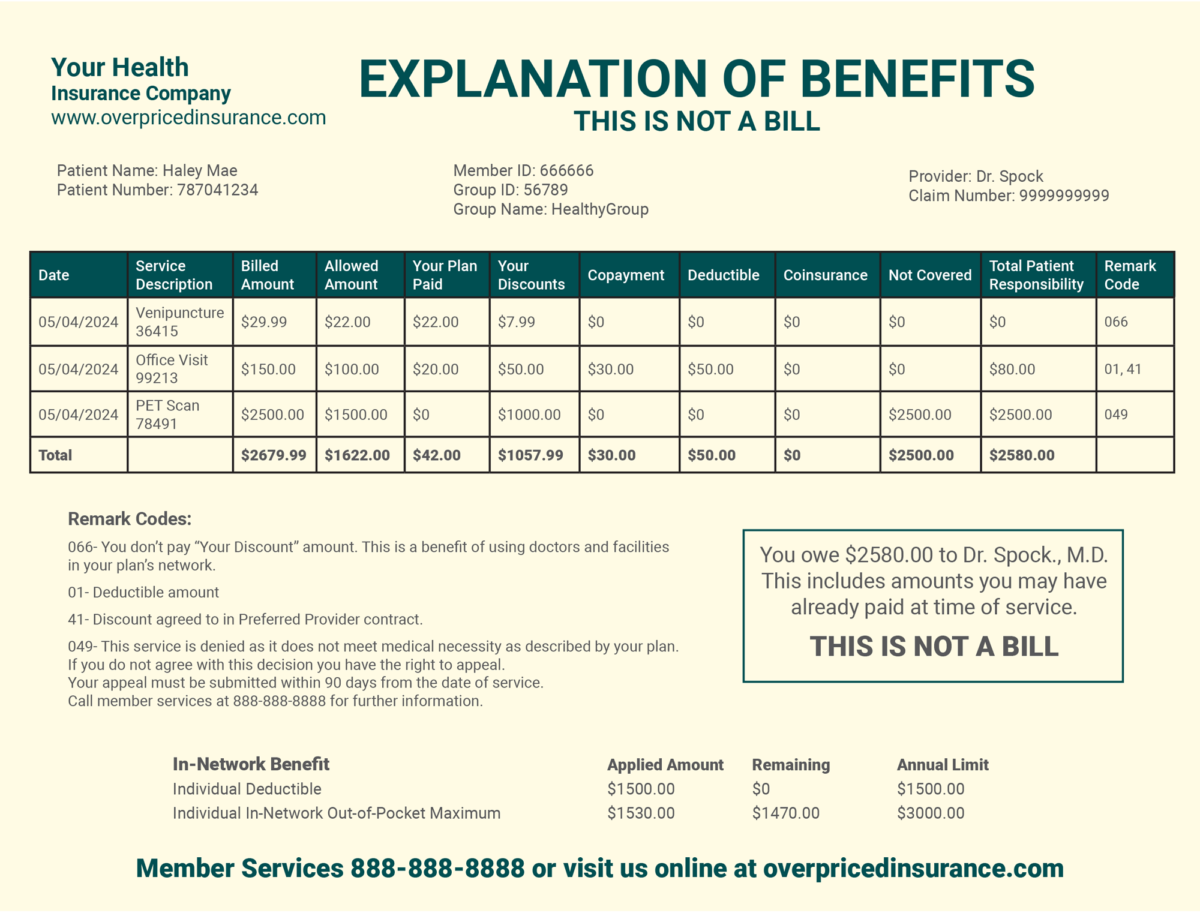

What’s an Explanation of Benefits (EOB) and Why Compare It to My Medical Bills?

Few things are more boring than insurance documents and statements. However, to stay on top of your finances and not overpay for medical bills, you must pay special attention to your Explanation of Benefits (EOB). By following Crush Medical Debt™ you have learned to review and reduce your itemized medical bills, with or without insurance.…

-

Tips For Communicating with the Healthcare Billing System

Battling the healthcare billing system and insurance companies can be extremely stressful. The time and energy required for disputing overpriced or erroneous bills, writing letters, obtaining records or preauthorizations, appealing claim denials, dealing with bill collectors, and making phone calls can feel like you’re working a stressful job you never even applied for! It can…

-

What to Do If Your Medical Bill Is Sent to Collections–How to Negotiate a Lower Payment with a Debt Collector

Medical debt is a heavy burden, but it’s especially stressful when debt collectors start calling and demanding payment. But don’t panic. You may be able to deal with debt collections so it won’t affect your credit report or lead to financial ruin. With a little bit of knowledge and a lot of persistence, you can…

Protect Your Finances from the

#1 Cause of Debt and Bankruptcy!

Get the latest Medical Financial Literacy content and resources to help you navigate the medical system and minimize healthcare costs for free in under 5 minutes.

Written by insider subject matter experts, not AI.