Are you worried about the high deductible and out-of-pocket expenses left behind by your health insurance plan? After all, you are functionally uninsured until you meet your deductible. Or perhaps, you have been unable to obtain affordable, comprehensive health insurance from the private commercial market or the ACA Marketplace. If any of these scenarios fit, supplemental insurance could help protect your finances.

What is Supplemental Insurance?

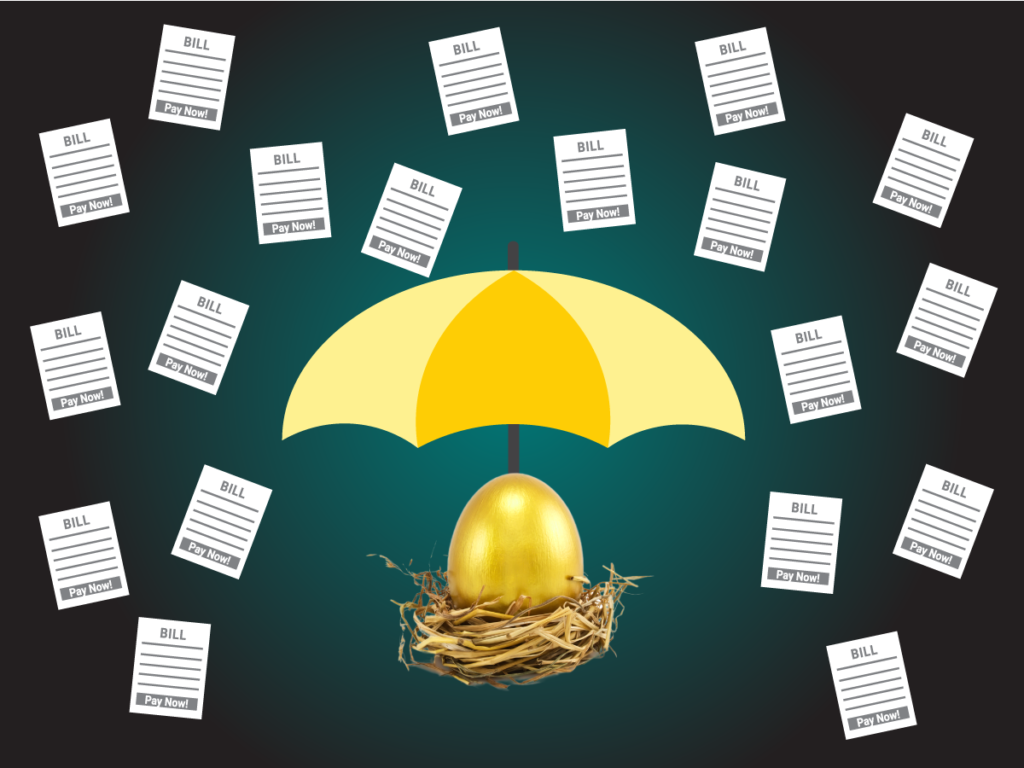

Supplemental insurance has been called “insurance for your insurance.” It works alongside your primary medical plan to help pay bills major medical insurance doesn’t completely cover. Supplemental insurance helps protect your finances by minimizing out-of-pocket expenses, including copays, coinsurance, and deductibles. Additionally, some plans cover expenses health insurance won’t cover, like alternative therapies or income loss.

Supplemental plans are found in the private or commercial market, outside the Federal Marketplace. Many employers also offer supplemental coverage options.

Why You Might Consider Supplemental Insurance?

Despite gains in coverage and access to care due to the Affordable Care Act (ACA), studies by the National Institute of Health (NIH) suggest that it did not change the proportion of bankruptcies with medical causes. Medical costs continue to outpace incomes, leaving millions uninsured or underinsured. Moreover, having health insurance doesn’t protect you from unpredictable, unaffordable out-of-pocket costs and high deductibles.

What Supplemental Insurance Isn’t

Supplemental insurance is not designed to be primary healthcare coverage. These plans are not regulated by the Affordable Care Act, also called Obamacare. Your application is subject to medical underwriting and can be refused based on preexisting conditions. Medical underwriting describes how insurance companies determine your health status when you’re applying for insurance coverage.

Medical underwriting is used to determine:

- whether to offer you coverage

- how much to charge you

- what exclusions or limits they will put in your policy

Supplemental coverage is:

- not comprehensive healthcare coverage or Qualified Health Plans

- very limited and specific

- not guaranteed

Because of its narrow scope, it’s important to be fully informed about what your policy covers and doesn’t.

Supplemental Insurance with Direct Primary Care

If you’re uninsured but healthy, consider supplemental coverage with a Direct Primary Care (DCP) membership. A DCP will help cover your primary care needs while supplemental policies can help protect your finances from unexpected critical health problems.

Types of Supplemental Insurance That Help Protect Your Finances

Supplemental plans may pay for covered services or may pay an indemnity, which is a fixed dollar amount per day. Supplemental plans that pay you – the policyholder – when a covered illness or event occurs are called indemnity plans.

Medical Indemnity Plans

Medical Indemnity plans often require that you pay upfront for services and then submit a claim for reimbursement. Sometimes called fee-for-service, these plans generally have no network restrictions – you can use any medical provider or hospital. Some medical indemnity plans have little or no deductibles.

With fee-for-service, you or the provider sends the bill to the insurance company, which pays a percentage of what they consider the “usual and customary” charge for covered services. If the provider charges more than the covered rate, you’re responsible for both the coinsurance and the difference.

Depending on your policy’s fine print, these plans can pay for medical tests, prescriptions, doctors, and hospitals. However, they may not pay for some preventive care, like checkups.

Note: fee-for-service is also a term often applied to original or traditional Medicare, to distinguish it from Medicare Advantage plans and other payment systems.

Hospital Indemnity Insurance

Hospital indemnity insurance pays you for hospitalizations due to illness and injury. It can help cover expenses health insurance doesn’t cover, such as copayments and deductibles, and expenses that occur during hospitalizations. However, it typically does not cover treatment costs outside of the hospital stay.

Critical Illness Insurance

Critical illness insurance is sometimes called dread disease plans. This type of indemnity plan helps protect your finances by paying you a lump sum upon the diagnosis of a covered critical illness or event. It offers benefits for many serious illnesses with very high costs, such as cancer, heart attack, or stroke.

Depending on the details of your policy, critical illness insurance can provide financial support to cover:

- out-of-pocket costs

- treatment costs

- medical expenses associated with the illness

- alternative therapies or treatments insurance doesn’t cover

- lost income to pay non-medical expenses

Critical illness plans have become popular among employers and individuals who buy them to supplement high-deductible primary health insurance plans. While this type of insurance doesn’t cover every health problem, critical illness insurance can be particularly useful if you have a family history of developing a covered condition.

Disability Insurance

Disability insurance helps protect your finances by paying a percentage of your income if you get sick or have a physical or mental disability that keeps you from working. If you own a business, you can potentially get a plan that pays your business overhead, employee compensation, property taxes, and other expenses. Your policy will define disability, injury, or illness that qualifies for benefit payments.

You can purchase long-term and short-term policies.

- Short-term: usually pays up to a year

- Long-term: pays you up to the maximum number of years outlined in your policy

Your premium and benefits will depend on:

- which insurance you buy

- how much and how long it pays

- how long you have to wait before it begins paying

Another type of disability insurance is Social Security Disability Insurance (SSDI). It’s a federal program for disabled people who can’t work. The physical or mental disability must last a year or more. SSDI is intended for people who can’t do any type of work. For example, if someone loses function of their legs, they are expected to switch to doing desk work.

Accident and Term Life Insurance

Accident policies offer a cash benefit when people experience injury or death due to an accident. Term life insurance provides money for your family or dependents if you die.

Dental and Vision Insurance

Vision or dental insurance are plans for your eyes and teeth. These types of insurance are often bundled with many comprehensive healthcare plans to make them more attractive to consumers. Additionally, vision and dental coverage are essential health benefits for children covered by ACA-compliant health insurance.

Long-Term Care Insurance

70% of adults who survive to age 65 develop severe long-term services and support needs before they die. These include paid home health care and residential care, such as nursing homes, assisted living communities, skilled nursing facilities, and hospice care. The prospect of becoming disabled and needing long-term services and support is perhaps the most significant risk facing older Americans. Long-term care insurance is designed to protect your finances and prevent long-term care from quickly eating up your retirement nest egg and assets.

More Healthcare Coverage Options to Protect Your Finances:

In ACA Health Insurance or Qualified Health Plans (QHPs): Coverage and Protections, you will learn about comprehensive insurance offered by the ACA Marketplace. However, if you want to look for comprehensive insurance coverage in the private, commercial market, Health Insurance Alternatives To The Affordable Care Act (Obamacare) could be helpful.

In our article, What if I Can’t Afford Health Insurance? we explore government-sponsored health programs. Additionally, you can learn about alternatives to traditional health insurance in Cash for Healthcare and Options for the Underinsured and Uninsured.

If you want a comprehensive overview of health insurance and coverage options in the U.S., check out the book, Decoding Health Insurance and the Alternatives: Options, Issues, and Tips for Saving Money, by Lauren R. Jahnke.

Take-Aways:

- Supplemental insurance works along with your primary medical coverage to help protect your finances from unpredictable, unaffordable medical costs and lost income.

- Supplemental insurance is not comprehensive healthcare coverage, nor designed to be your primary healthcare coverage.

- Supplemental insurance can be paired with Direct Primary Care or your primary medical insurance to help minimize costs.